Pivot Strategic Consulting 2023 – Q2 Newsletter

May 19, 2023

Pennsylvania Updates

Pennsylvania Releases Corporation Tax Bulletin 2023-01

On May 1, 2023, the Pennsylvania Department of Revenue released guidance on the treatment of electricity for corporate net income tax apportionment purposes. It addresses that the sale of electricity is treated as the sale of tangible personal property and apportioned using a market based approach. Read more on Tax Bulletin 2023-01

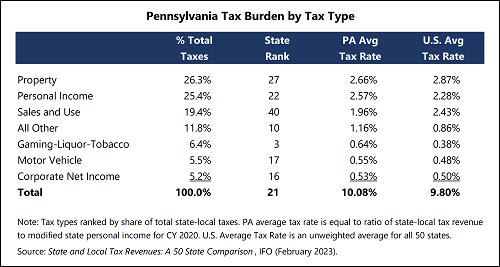

Pennsylvania Ranks 21st for State and Local Tax Burden

The Pennsylvania Independent Fiscal Office released its annual report, State and Local Tax Revenue: A 50 State Comparison. The report compares state and local taxes paid relative to total state income and the distribution of state and local taxes across revenue sources. The chart above lists Pennsylvania’s tax burden by tax type, ranking 21st overall.

Former PA Senator Patrick Browne is working as the Secretary of the Department of Revenue

Former Pennsylvania Senator Pat Browne is working as the Secretary of the Department of Revenue. Secretary Browne has a long history of dealing with state tax issues from a taxpayer and tax practitioner perspective. Pivot Strategic Consulting is looking forward to working with Secretary Browne to ensure that taxpayers and tax practitioners in Pennsylvania have their issues addressed.

A Note to PA Taxpayers on Sales and Use Tax Topics

Pennsylvania’s Department of Revenue has been giving scrutiny to inter-company transactions to determine if these are possibly taxable in nature. Taxpayers should consider reviewing inter-company transactions and agreements to determine if these are in fact taxable or could be deemed taxable based on Pennsylvania policy. In addition, Pennsylvania has been requiring significant documentation to support the exemption from Pennsylvania sales and use tax for use of software outside Pennsylvania, this is an area that should be reviewed. In addition to the taxation of software, Pivot has heard numerous issues regarding the state taxation of various computer and consulting services as being part of the sale of software.

Other State & Local Tax Updates

______________________________________________________________________________________________________

Maryland Court Reverses Ruling on Digital Ad Tax

Maryland’s Supreme Court reversed a ruling on May 10, by a lower court that the state’s first-in-the-nation tax on digital advertising was unconstitutional. The Court dismissed the case on procedural grounds that the case should have been brought up through Maryland’s tax courts and will provide additional reasoning in the near future. Maryland’s Attorney General, Anthony Brown provided the following comment:

“I applaud the Supreme Court for acting quickly because the revenues generated by this tax will help us provide our children the best education possible for success,” Brown said in a statement. “The digital ad tax will support our collective goal of transforming schools across the State. It will help level the playing field so that underserved communities will have access to quality educational opportunities enjoyed by our highest performing schools.”

Maryland is suggesting that taxpayers who delayed or ignored their filing requirements should file tax returns and remit payments as soon as possible. Taxpayers who owe this tax but did not file nor pay should consider seeking a voluntary disclosure agreement to avoid penalties that could be imposed by the non-filed returns. Pivot will being staying tuned for further actions on this issue.

Minnesota Changes Plan on Multinational Corporation Strategy

Minnesota was looking to target multinational corporations using various strategies to shift income out of the state by providing for adding back foreign subsidiary profits and essentially, remove the water’s edge rules currently in place. The proposed legislation appeared to have great support from the legislators. However, the business community pushed back hard on this change and it appears Minnesota will scrap this strategy and is considering two other options to generate additional tax revenues. The first option would be to impose a business profits tax associated with intangible assets held offshore by subsidiaries. The second option being considered is phasing out itemized deductions available to high income taxpayers.

Louisiana’s Sales Tax is Challenged By Retailer

Louisiana’s local based approach for registration, filing and paying local sales and use tax was challenged by Halstead Bead Inc. It appears that shifting to a more state-wide centralized approach is not gaining traction in the courts. Recent legislation to centralize the local sales and use tax process was also not successful. Keep an eye on how this progresses.